In the wake of one of the most shocking and intriguing stories to grace Wall Street this year, market writers are eager to reinforce the idea that making money in stocks is easy. Stories of abnormal wealth creation serve as the justification for many a college-dropout, and help mitigate the cognitive dissonance incurred from falling short of our perceived potential for unlimited success. While many were quick to question the validity of Mohammed Islam’s supposed overnight fortune (and it turns out they were right to), the sentiment remains: with enough time and a little know-how, you can still get rich quick in the stock market.

Are journalists wrong to glorify these outliers? Given the sluggish economy and the growth of automated investment platforms, it makes sense that they would be trying to find ways to get young people interested in buying equities.

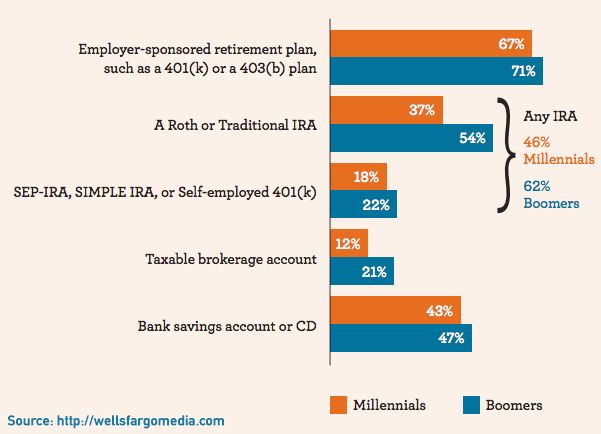

According to 2014 research by Wells Fargo, our generation is all but completely financially inept. More Millennials spend time thinking about their financial future than the Boomers before them (53% vs 40%, respectively), but are ironically terrible market participants by comparison. A mere two-thirds of our generation contributes to an employee-sponsored retirement plan, like 401(k)s and 403(b)s, and less than half of us contribute to a traditional or Roth IRA. Only 12% of us have taxable brokerage accounts, even though a reported 59% of us believe that the stock market is the best place to invest for retirement, and above all, we have an average savings rate of -2%. Is it possible that we're so naive to assume immunity from our expenses? Or do we overspend in anticipation that our future success will counter-balance our lavish lifestyles?

The irony is that the first fully tech-savvy generation is not leveraging the available data that could provide the foundation for financial wisdom. To that end, technology has made it easier to invest and track financial performance than it ever has been. The internet is teeming with investment advice, from penny stock peddlers to ETF evangelists, which can make the world of investing seem intimidating and endlessly complicated. Despite all of this, equipped with tools like Acorns and Robinhood, and money management tools like Mint, Simple, and Personal Capital, even the most novice of investors can start to put their money to work from their smartphones without ever having to call a broker.

This is all very convenient, given the access to prolific information on virtually any topic, and our resulting appreciation for doing things on our own. You're constantly mere seconds away from learning about anything you've ever been mildly curious about. The inevitable product of this instant access is our propensity to consult online tools for validation of our health, often before, or even in lieu of the examination of a professional. From that perspective, paying a financial professional for investment advice seems like an irresponsible use of resources.

The reality is that investing in stocks is neither scary nor difficult. You don't need to understand PEG ratios to benefit from investing your capital. If you were so inclined, you could open accounts with the aforementioned tools and start letting your money work for you as early as tomorrow morning. A licensed broker can help find appropriate securities within the context of your goals and risk tolerance, but if the thought of someone else managing your hard-earned cash keeps you up at night, all of the tools you need are out there, waiting for you to take the first step.

Why Today?

To many young professionals, investing seems like something that can wait. Wait until my car is paid for, wait until I’ve paid off my student loans, or just wait until I’ve settled down. You won't need the money for at least another 10 years, so why not focus your budget on getting out of debt today? The simple principles of the time value of money would suggest otherwise. You don't need me to tell you that investing early is a good idea, because you've heard it all before. How can I risk losing my assets in relatively volatile investments when I have bills to pay? Why isn't it safer to keep my cash in my account, where I can see it?

A common adage teaches us to pay ourselves first, before our monthly expenses, before our obligations, and long before any discretionary purchases. In practice, this means actively setting money aside for your future before your rent is paid. Let’s look at an example of why this makes sense:

Say you start a new investment account today with $1000, at age 20, and you make a personal pact to contribute $50 every month until the day you retire at the current average of 62. Let’s say you’ve also constructed a well-diversified portfolio that accurately performs with the market. Given the annualized return of the S&P 500since 1954 is 7.03%, here’s what the returns on that account look like:

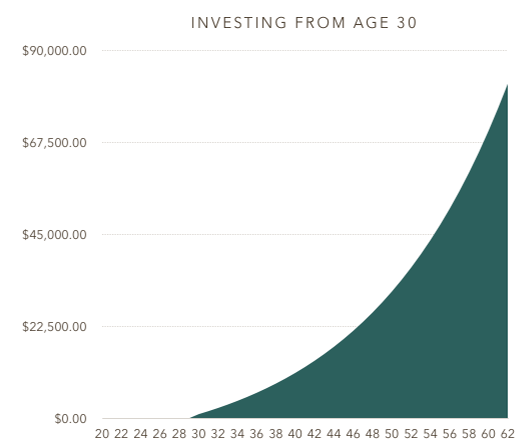

Assuming no contribution increases over time, we end up with $172,545 after 42 years, all while adding less to the account than your phone bill. Now what happens if you open the same account with the same rules at age 30?

Starting later, you end up with only $82,301 by the time you’re 62. By waiting until your finances were stable, your potential earnings are effectively cut in half. If we’re talking about an employer-sponsored investment account with a percentage match, the losses are even more devastating. The question you should be asking yourself at this point is whether you want to do this calculation again in 40 years and wonder why you never started earlier. Some analysts estimate that our average retirement age will be as high as 73 by that time. Think of the fortune you could amass by adhering to a simple strategy.

What's next?

Designing your strategy can be a complicated process, but it doesn't need to be for you to be successful. Come up with a general goal, like "I want to save $2 million for retirement", or "I want to afford the 20% down payment on a $500k house in 20 years." Next, figure out what your risk tolerance is, and what the risks are. Volatility is less of a factor for long-term retirement accounts, while inflation won't matter as much for your short-term goals. Only you can decide how much these things affect your strategy. A tool like this one can help you decide how much you'll need to contribute to your investments each month to reach your goal.

Next, pick the securities that fit into your plan. A few common pitfalls include chasing trends, and trusting that successful fund managers will continue to sustain growth. Before hopping on the bandwagon, consider that people plugging a specific security usually have their own reasons for doing so, and are not always the selfless evangelists they may claim to be. First-time investors often choose stocks of brands and companies they know and love, but with small amounts of starting capital, this makes it very difficult to limit your overall exposure to a particular company, and prevent losing a significant chunk of your money if they go south. Alternatively, choosing low-cost Index funds and sector Exchange-Traded Funds can help you diversify your assets quickly without succumbing to absurd fund fees or high-risk stocks. There are literally thousands of tools to help you find securities that meet your individual needs.

Finally, pick the brokerage where you'll manage your money. If you need some guidance picking the right place to open an account, Barron's releases a very thorough guide to online brokerages annually.

In the words of one of the greatest investors of our time:

Do not save what is left after spending, but spend what is left after saving.

- Warren Buffett